The luxury residential market in Portugal continues to boom, with the Algarve, Porto and Lisbon in the spotlight. These conclusions are in The Wealth Report, an annual study by the consultancy Knight Frank, partner of the real estate agency Quintela e Penalva since 2021, which also reveals that one million euros is just enough to buy 67 m2 in Quinta do Lago, while the same amount is possible to purchase 110 m2 in Barcelona or 90 m2 on Lake Como, in Italy.

The scarcity of supply and the unique character of Quinta do Lago explain the sharp increase in prices.

The study shows that the Algarve is in the top 5 global markets in the luxury residential sector, where prices had the best performance in 2023.

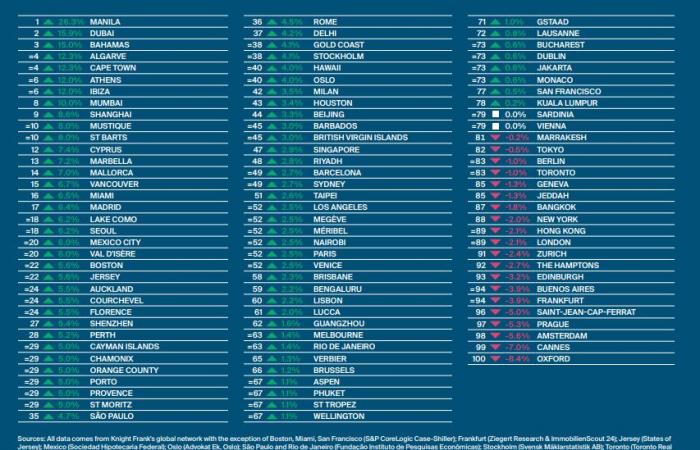

According to the study, among the 100 most sought after destinations in the world in terms of price appreciation in 2023, the Algarve appears in fourth position, with a price increase of 12.3%, just behind destinations such as Manila (Philippines, 26, 3%), Dubai (United Arab Emirates, 15.9%) and Bahamas (15%).

Lisbon and Porto continue to grow

The list of cities and regions that register stable or positive annual price growth include the cities of Lisbon and Porto. The two cities remain in positive territory, with growth of around 2.2% and 5%, respectively. Thus, Porto appears in 29th position, ahead of São Paulo, Rome, Barcelona, Milan or Paris. Lisbon, on the other hand, is in 60th place, and surpasses cities like Dublin, Vienna, Tokyo, Berlin or New York.

The Knight Frank study also reveals that the price of luxury properties in Lisbon is still expected to grow, in 2024, by around 2.5%, being preceded by Seoul, South Korea, Zurich, New York or Paris.

For Francisco Quintela, CEO of Quintela e Penalva, Knight Frank’s partner in Portugal, “Lisbon continues to be on the radar and appears in the top 10 of the survey in terms of location for new buyers, as shown in The Wealth Report. The forecast for growth in luxury prices in Lisbon continues to be very significant, as demand continues to be very strong in the luxury housing market, particularly in Lisbon, Cascais and Comporta, where demand for luxury properties has increased significantly.” He also adds that this reality “is mostly corroborated by the interest and completion of business by foreign investors, with high investment capacity”.

According to The Wealth Report, which tracks the performance of luxury properties in 100 key locations (including cities, sun and ski destinations), 80 locations have recorded stable or positive annual price growth.

Manila (26%) leads, but last year’s leader Dubai (16%) dropped just one place. Asia-Pacific (3.8%) overtook the Americas (3.6%) to take the title of best-performing global region, with Europe, the Middle East and Africa lagging behind (2.6%). As predicted last year, sunny locations continued to outperform, with an average increase of 4.7%, followed closely by ski resorts (3.3%) and cities (2.7%). .

According to Knight Frank’s The Wealth Report 2024, the number of UHNWIs in Portugal – those with a net worth of $30 million or more – will increase by 25%, reaching 1000 individuals by 2028. For Kate Everett-Allen, Head of International & Country Research at Knight Frank,” this fact, combined with the expectation that the ECB will begin reducing rates in the summer, along with the recovery of the country’s tourism sector, will attract more second home owners and investors. It is therefore expected that luxury prices will increase by 2.5% in Lisbon in 2024”.