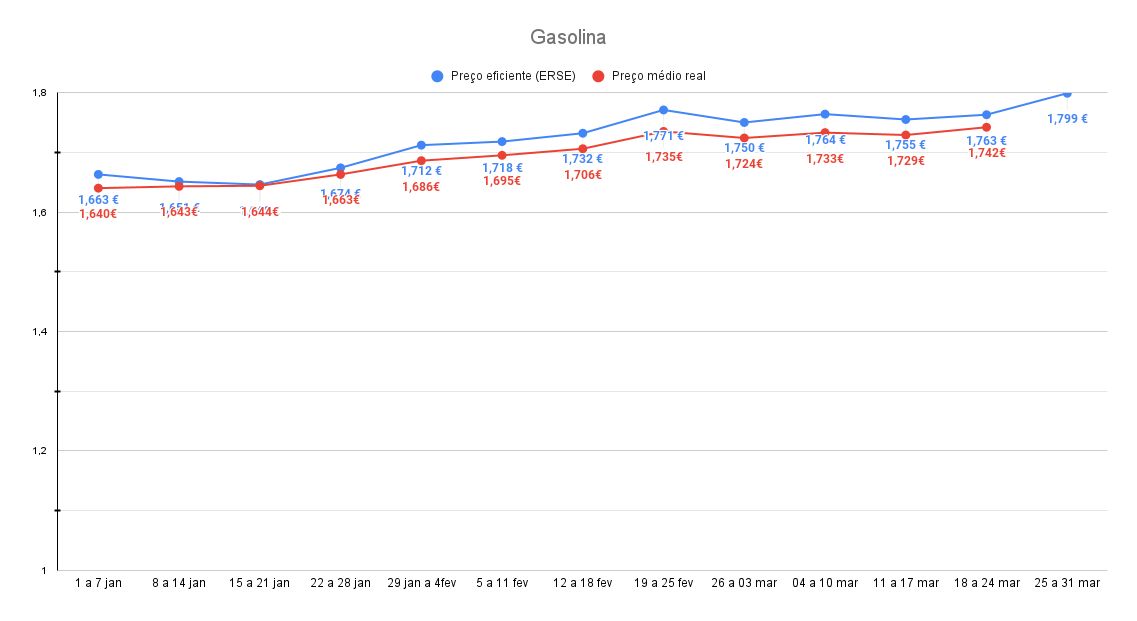

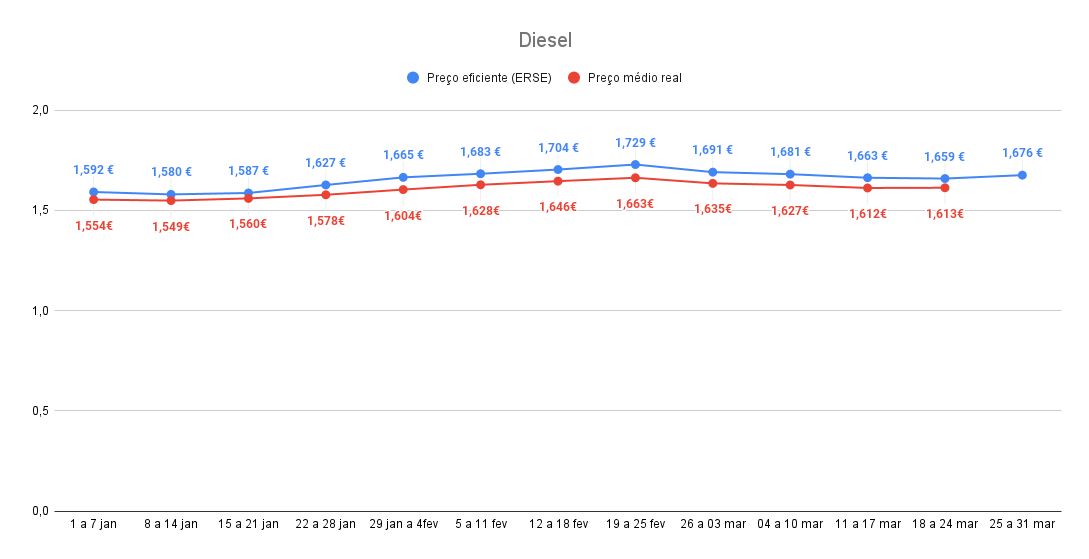

ERSE does the math every week so the consumer knows what the “fair” price of fuel is in relation to the price of raw materials and fuel transport. This “fair” price already includes a profit margin of around 10% for brands.

The average weekly price, calculated by the Energy Services Regulatory Authority (ERSE), for the week between March 25th and 31st, before taxes it is 0.884 euros/liter for simple 95 gasoline and 0.919 euros/liter for simple diesel. ERSE also assesses whether brands applied prices above or below this “efficient” price in the previous week.

Here at Contas-poupança we are not particularly interested in last week, but rather what we can do this week to spend the right price when filling up.

In the weekly report, the regulatory authority also warns – let’s be fair – that with the application of discounts (each brand has its own), the prices charged in reality often end up being below the efficient price.

How should you use this information

As you know, every Friday we make a forecast here at www.contaspoupanca.pt, of the rise or fall in prices the following Monday, to know whether you should fill up that weekend or if you should wait a few days to fill up and save. a few euros. It will never be a fortune, but I remind you that 10 euros in savings per month (by intelligently managing the price of supplies) is equivalent to 120 euros at the end of the year. We are talking about two “free” deposits per year. It may or may not be relevant. Only you know.

In addition to this information, for which only I (Pedro Andersson) am responsible, using my sources in the sector, ERSE produces this weekly report where it indicates its accounts for what it considers the fair price to pay given all market circumstances. You should use these numbers when you have doubts about the price charged at a service station. If it is close to, or even below, the value published here, you are saving. If it is much higher, you should consider looking for a gas station nearby that is charging the closest price to those mentioned below.

This week (March 25th to 31st), the efficient prices for gasoline and simple diesel are:

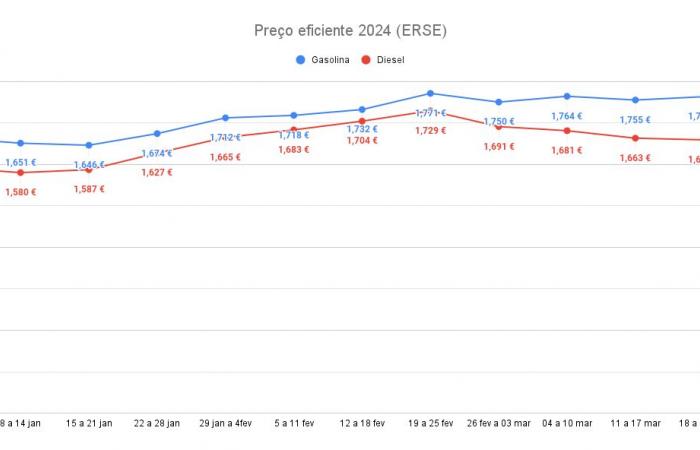

The following graph shows the evolution of the efficient price from January 2024 to the current week. You must understand that it is not the price being charged by the filling stations, but rather the price that is considered fair given the costs of purchasing raw materials, transport, distribution and sales, including taxes.

If you’re going to refuel this week, check out this article before jumping in and see if you’re going to save or if you’re possibly wasting money and how much.

The efficient price is an average weekly price determined by ERSE, which results from the sum of several factors: fuel prices in international reference markets and the respective maritime freight, primary logistics, including in this portion the strategic and security reserves of the System National Petroleum, the additional costs with the incorporation of biofuels and the retail component plus the respective taxes.

With this value from ERSE, you have a weekly gauge to know if you are paying too much or the right price when filling up with fuel.

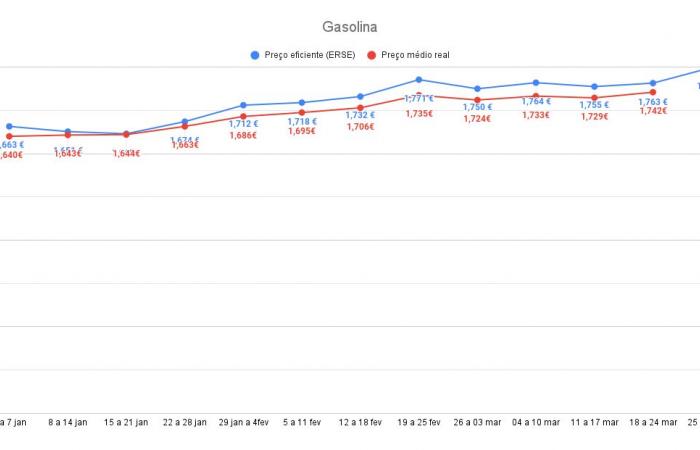

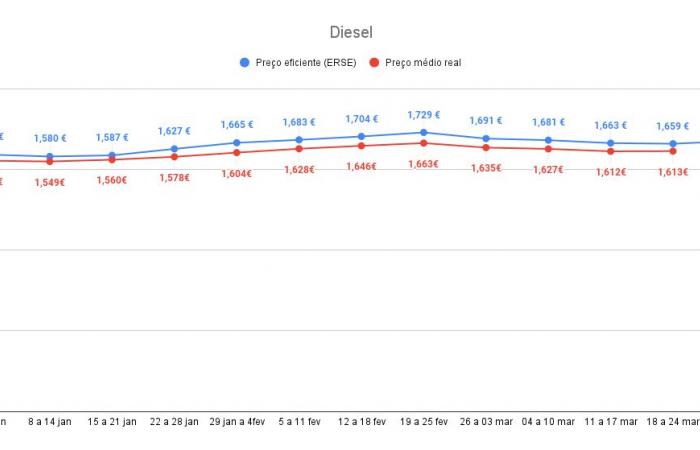

However, as each brand can apply its own discounts, it is normal that the actual prices charged may be below what ERSE predicts as fair prices. In fact, the trend over the last few weeks has been exactly that, both in gasoline and diesel, as you can see in the graphs presented below.

In just 5 steps, you will find the most effective strategy for creating wealth with your salary.

https://bit.ly/GanharDinheiro_ComoCriarRiquezaComUmSalárioNormal