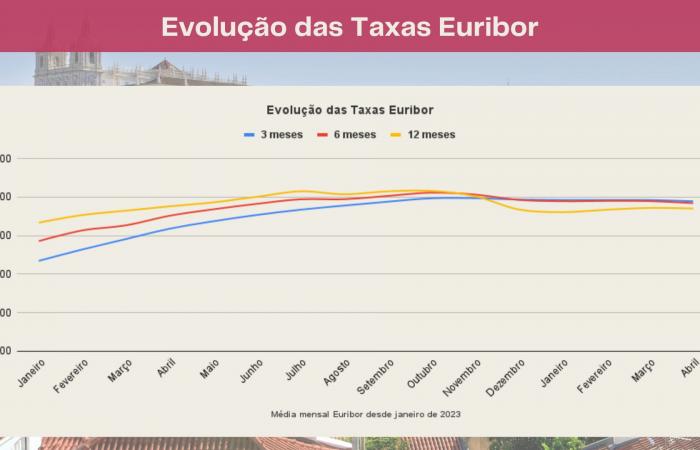

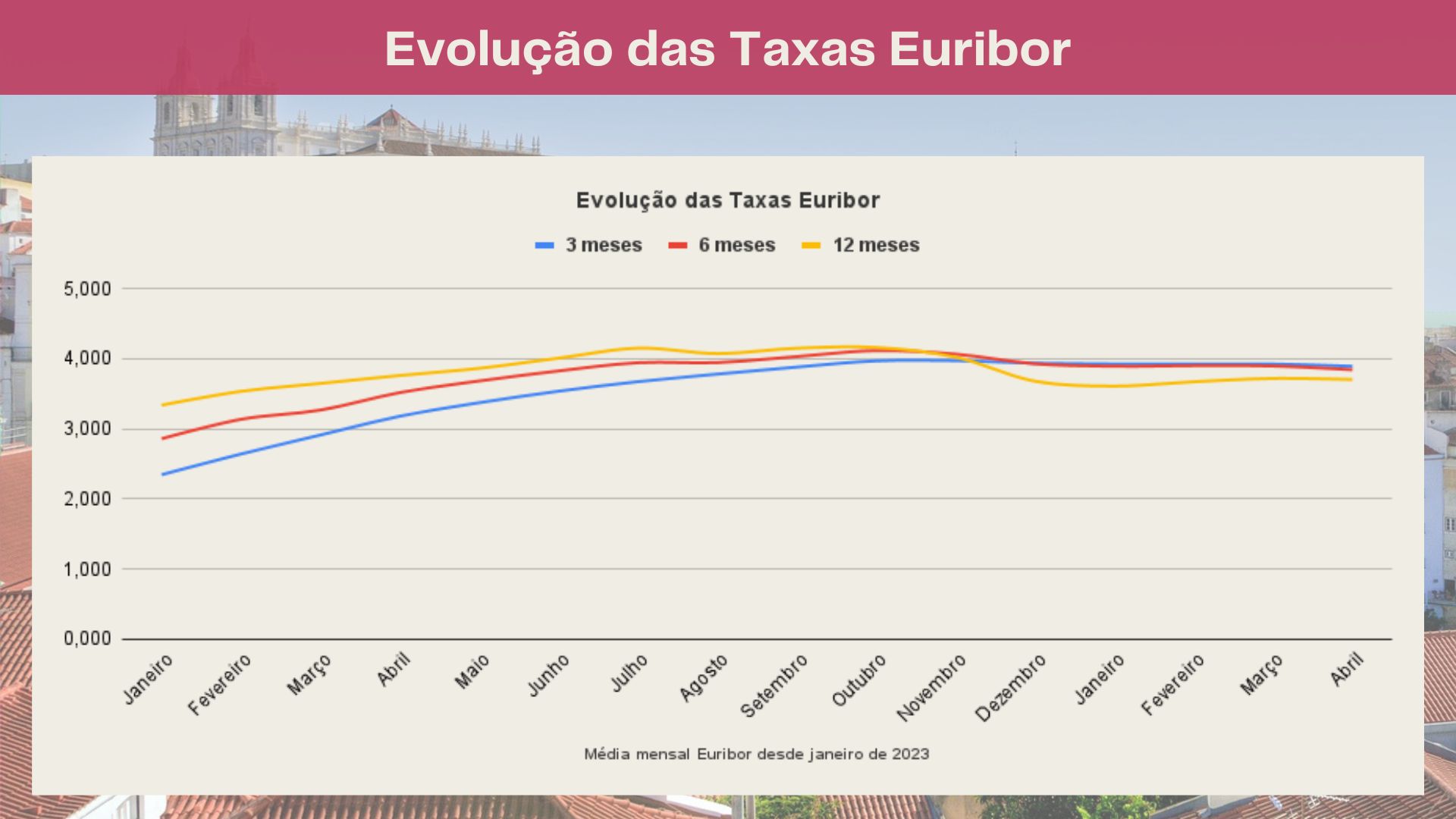

Daily, we publish here on the “Savings Accounts” page the value of Euribor rates for three, six and 12 months. Although daily changes do not have a direct impact on your mortgage loan payment, they are a valuable indicator to understand the trend in the amount payable in the next installments. We hope this is useful information so you always know what to expect in the future.

EURIBOR | April 26, 2024

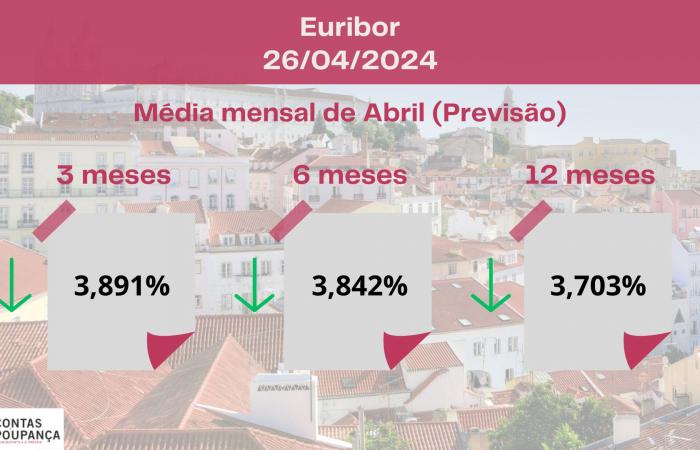

Euribor rates rose for three and six months this Friday, but fell for 12 months. Despite the changes, they remain below 4% across all maturities.

Today, the three-month Euribor increased to 3.865%, plus 0.001 points, as did the six-month rate, which increased to 3.835%, plus 0.010 points compared to Thursday. Conversely, the 12-month rate fell to 3.724, 0.004 points less than the previous session.

Despite the fluctuations in recent days, the average for each period still remains below the values recorded at the end of March.

The Euribor varies daily in the various terms, which means that your installment can always increase or decrease every three, six or 12 months, depending on the Euribor rate you have chosen. If you are going to take out a new loan or if you have questions about whether you should change your current term, check out this article which contains everything you need to know about Euribor.

In just 5 steps, you will find the most effective strategy for creating wealth with your salary.

https://bit.ly/GanharDinheiro_ComoCriarRiquezaComUmSalárioNormal

Savings accounts – How to overcome inflation and benefit from the crisis

Savings accounts – Beat the crisis with intelligence

Savings accounts – Save even more, Invest better

Savings accounts – Live better with the same money

![]()