The consumption tax reform regulations provide for tax exemptions for 383 medicines and vaccines, including vaccines against Covid-19, dengue fever and yellow fever. The text, sent to the National Congress on Wednesday (26), also proposes a reduction in the rate by 60% for 850 medicines.

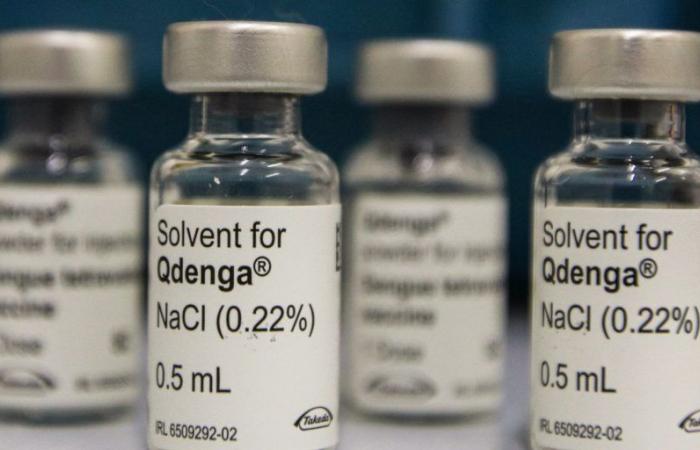

Among the exempted medicines are vaccines against covid-19, dengue, yellow fever, flu, cholera, polio and measles, as well as substances such as insulin (used for diabetes) and the antiviral abacavir (used against HIV). Sildenaphilia citrate (used to treat erectile dysfunction) will also not pay tax.

Among the active ingredients with a reduced rate are omeprazole (used to treat reflux and digestive ulcers), the anxiolytic lorazepam, the high blood pressure medication losartan, metmorphine (used for diabetes), the anti-inflammatory, anti-allergic and anti-rheumatic prednisone and the sexual impotence medication tadaphilia.

The complementary bill regulates the collection of Value Added Tax (VAT). This tax is made up of the Contribution on Goods and Services (CBS), collected by the federal government, and the Tax on Goods and Services (IBS), which is the responsibility of states and municipalities. The government’s expectation is to approve the text by the end of July in the Chamber and by the end of the year in the Senate.

Cumulativeness

In a press conference to explain the complementary bill, the extraordinary secretary for Tax Reform at the Ministry of Finance, Bernard Appy, said that the approval of the proposal as sent by the government will allow “a relevant reduction in costs” of medicines. In addition to the reduction or exemption of rates, he highlighted that the end of cumulativity (cascade charging) will result in lower prices.

“Not only because of the rates, but today there is a cumulative nature that will no longer exist. When the medicine with [cobrança de] ICMS [Imposto sobre a Circulação de Mercadorias e Serviços, que vai deixar de existir] goes to a reduced rate, there is a large reduction, from 20% to 10% [na carga tributária]. If [atualmente] It already has a zero rate, it remains exempt, but it gains because it is no longer cumulative”, stated Appy.

According to the government’s proposal, the average rate will be 26.5%. If there is a 60% reduction in the general rate, medicines with the benefit will only pay 10.6% tax.

Check out the tax-exempt medicines under the project below (between pages 280 and 291).

Check out the medicines that will have a 60% reduction (between pages 239 and 264).