Polygon (MATIC) performed well this week. Its price has risen 6.7% in the last seven days, according to CoinGecko.

Technical analysis shows that the altcoin’s price is close to breaking a chart pattern, which would cause its price to rise further. In parallel, data regarding movement on your network indicates that this is the most likely scenario today.

Polygon seeks to break out of triangle

Analysis of the 4-hour chart shows that MATIC entered an uptrend last Friday (19). The currency has formed higher tops and bottoms since then.

With this, the creation of an ascending triangle pattern was confirmed. Typically, this type of pattern leads to bullish breakouts, with a price projection being stipulated from the length of the bottom to the top of the triangle.

Sponsored

Read more: 4 cryptocurrencies that could reach new highs in April

If the Polygon network’s native token is able to break the resistance of this pattern, at $0.75, its top projection would be at $0.85 – 15% above the current price.

Exponential moving averages (EMAs) indicate that a breakout is the most likely scenario. This is because the 9-period EMA (blue) is once again above the 21-period moving average (orange), which confirms that the trend is upward.

On-chain data is bullish

Sponsored

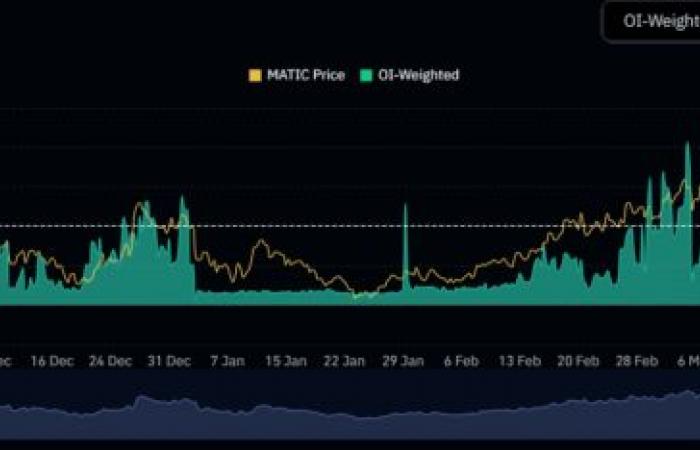

Polygon’s on-chain analysis also indicates that the altcoin will seek new highs. This is evident from the funding rate in futures markets, which is increasing and is no longer negative.

The funding rate represents the rate between holders of futures contracts buying (long) and selling short (short) to maintain price equilibrium. Typically, a negative rate represents the predominance of short contracts, while a positive rate shows that there are more long contracts.

The current increase in this rate shows that more traders are betting on MATIC rising. This could increase the current buying force and cause the altcoin’s price to continue rising.

Sponsored

Furthermore, only 6% of current holders of the asset are in profit, according to IntoTheBlock. In general terms, it is unlikely that those who are at a loss will want to sell their assets, and it is more advisable to wait for new price increases to recover their investments.

As a result, MATIC is unlikely to see great selling pressure, which could facilitate the path of bulls (buyers) towards new price tops.

Disclaimer

All information contained on our website is published in good faith and for general information purposes only. Any action the reader takes based on the information contained on our website is at their own risk.