The Ibovespa closed the last session in the negative, after a series of increases. As a result, it registered a drop of 0.34%, to 125,148 points. The index retreats after a sequence of three consecutive days of increases, and to resume the buying movement it will be necessary to overcome the resistance region at 126,080 points. However, it is worth paying attention, as the asset has broken the averages downwards and could intensify the downward movement if it breaks the 124,310 point range.

Based on the Ibovespa 60-minute chart, chart analyst Rodrigo Paz observes that the asset is seeking a buying reaction after a sequence of strong declines, despite the drop the day before. This occurred after reaching support in the range of 123,400 points, where buying force entered, driving the index upwards. However, attention should be paid if the asset breaks the 124,310 point range.

If the asset follows the downward flow of the previous day, it should break the region of 124,310 points. According to Paz, if it breaks, it will be able to continue with sales to seek new support bands. Breaking through this region, it tends to seek support in 123,400/123,000with a longer target in 121,630 points.

If the buyer flow resumes, it should return above the averages, and surpass the 126,080 points. Breaking through this range, you can gain momentum in order to look for a region of resistance in the 126,920with a longer target in the region of 127,860/129,180 points.

Day Trade today: Schedule

On today’s agenda, the corporate earnings season is highlighted in both Brazil and the United States, with balance sheets from the mining company Vale and Meta, owner of Facebook, after the markets close.

In Brazil, at 8 am, consumer confidence data for April will be released. At 10am, Gabriel Galípolo will participate, as a speaker, in the Upload Summit 2024 event, promoted by Upload Ventures. In the USA, durable goods data for March will be released at 9:30 am, and weekly oil inventories (AIE) data will be released at 11:30 am.

International markets

At 7:40 am, futures in NY were operating mixed: Dow, -0.03%; S&P500, +0.15%; and Nasdaq, +0.58%. In Europe, the Stoxx600 operates up 0.20%, and in Asia, the Tokyo stock market rose 2.42% and the Shanghai stock market rose 0.76%.

In the USA, the yield on 10-year bonds is up, at 4.638%, and the dollar index (DXY) is up 0.13%, at 105.82 points.

Meanwhile, WTI oil falls to US$82.95, with -0.49%, and Brent oil falls 0.37%, to US$88.09.

Iron ore traded on the Dalian exchange rose 3.08%, to 888.00 yuan, equivalent to US$122.55.

Minicontracts

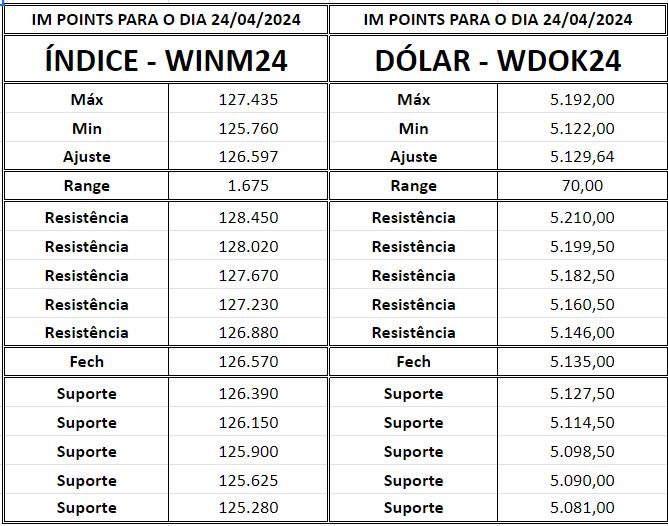

Mini-index contracts (WINM24)due in June, closed the last session in the negative, registering a drop of 0.64%, at 126,570 points.

Based on the previous day’s closing, at 126,570, technical analyst Rodrigo Paz points out how resistance 126,710/126,920 (1), 127,235/127,435 (2) and 127,655 (3). Meanwhile, the supports are in 126,410/126,125 (1), 125,790 (2) and 125,350/125,000 (3).

“For today’s trading session (Wednesday), traders should pay attention to a possible continued selling of the index. To follow this movement it will be necessary to break the region of 126,410 points. If the asset resumes the flow of purchases, it should surpass the range of 126,710/126,920 points”, points out Paz.

Minidollar contracts (WDOK24)due in May, closed the last session in the negative, registering a drop of 0.73%, at 5,135 points.

Thus, based on the previous day’s closing, at 5,135 points, technical analyst Rodrigo Paz points out the support 5,122 (1), 5,104 (2) and 5,086.5 (3). Meanwhile, resistance is in 5,137 (1), 5,162 (2) and 5,192/5,215 (3).

Based on the 15-minute chart, it is possible to notice that the mini-dollar contract is trading in a downtrend and could continue the declines. To do this, it will be necessary to break the range of 5,122 points. However, it is worth paying attention, as it has recovered above the averages and could seek a bullish recovery after a bearish sequence.

- Check out what to expect for the minidollar in this fourthMonday (24).

Support and resistance

Check now the main points of support and resistance for the dollar and index mini contracts for this Wednesday.

Check out more content about technical analysis on IM Trader. Daily, infomoney publishes what to expect from dollar and index mini contracts. The best platforms to operate on the Stock Exchange. Open an account with XP.