We recently spoke with the relationship with investors from the Locate (RENT3). We left with some qualitative insights that corroborate our recovery thesis for the company, mainly related to the challenging scenario in the used car market be cyclical.

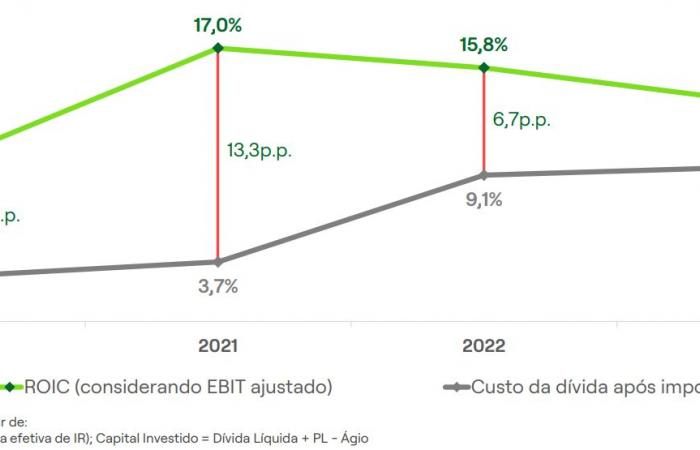

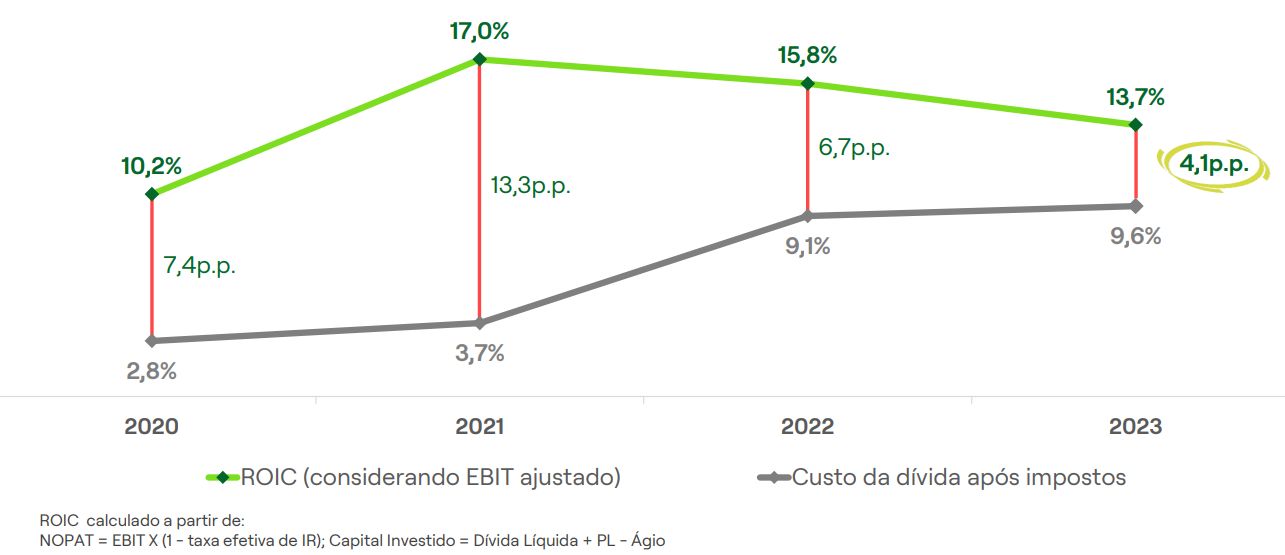

First, it is worth taking a step back to remember what is happening with Localiza and why its profitability, from the perspective of ROIC Spread, is at its lowest level in recent years.

A brief history of Localiza

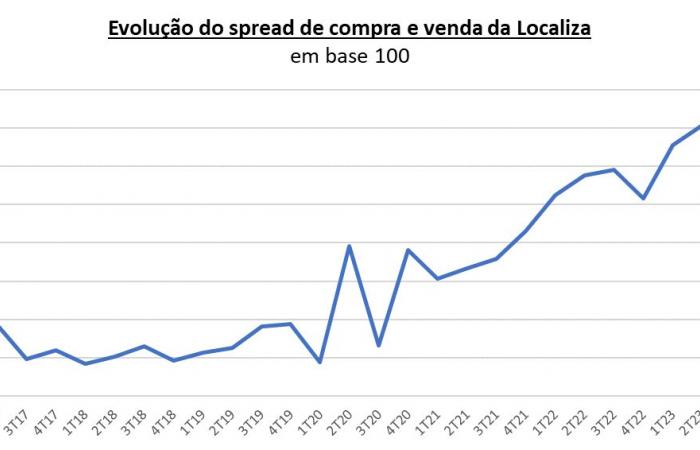

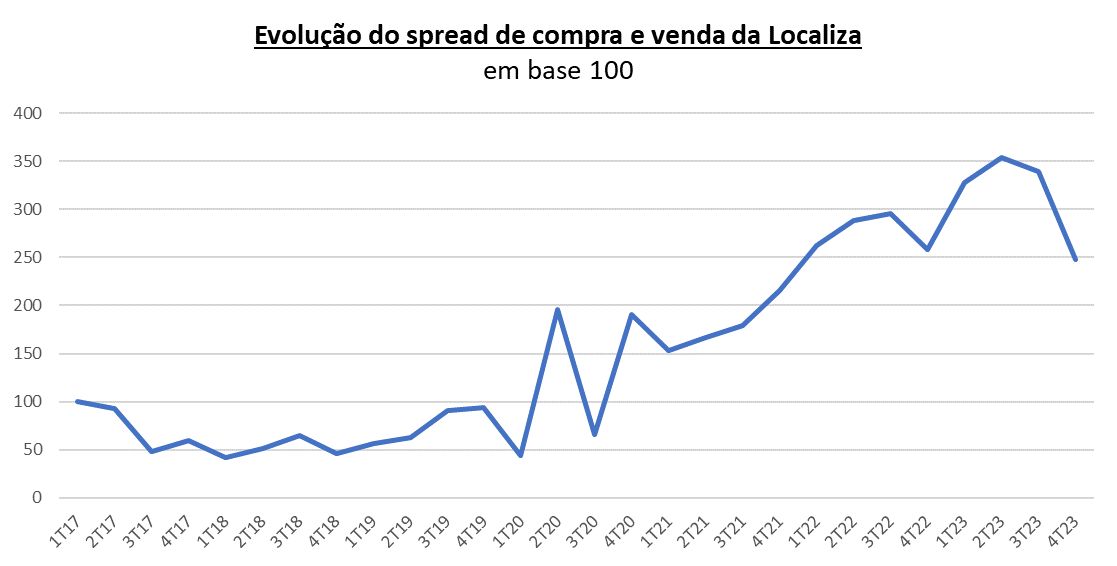

In essence, Localiza is a new car buyer and used car seller. A very important part of what the business margins will be comes from the spread between the purchase and sale. The more advantageous it is for the company, that is, the cheaper it buys and the more expensive it sells, the better.

Furthermore, there is another important concept for us to understand depreciation. The vehicle’s expected sales price makes up the company’s depreciation expense equation, which, roughly speaking, is the difference between the car’s purchase price and the estimated sales price at the end of its useful life.

Historically, this spread has remained at healthy and stable levels for the company, as has depreciation. This is because, in addition to the price of new and used cars have a strong historical correlation, Localiza is able to negotiate a significant discount with car manufacturers when purchasing cars, due to the size of their orders.

The problem, which affected the entire sector, began with the shock in the supply of vehicles during the pandemic, which continues to this day.

The conditions at the time, with lockdown, difficulties in the logistics chain and shortage of components, drastically reduced car production in the world, which led to a spike in prices — accompanied by the price of used cars.

At first this was positive, as with the increase in used cars, the company was able to sell vehicles at better prices, increasing operating margins and reducing accounting depreciation.

In that scenario, faced with a market with extremely high prices, Localiza chose to reduce both the expansion and renewal of its fleet.

Thus, the purchase of vehicles was significantly reduced (but still purchased, given the need to meet the demand for rentals) and extended the useful life of part of the fleet it had at the time to continue running the operation.

The idea was to sell this fleet and resume purchases when the price environment was more normalized.

Since then, despite some correction in the prices of new cars, they remain quite high, while the price of used cars has been falling gradually since 2022. Credit for purchasing used cars is quite restricted, domestic income is still under pressure and the MP for new cars in 2023 are some of the factors responsible for this price difference.

Thus, with cars purchased under worse price conditions during the pandemic (albeit in more limited quantity), a much older fleet than usual, weak demand for used cars and a lower estimated selling price, depreciation and the purchase and sale spread of Localiza became much worse (buying expensive and selling cheap), putting pressure on the profitability of the operation (as shown in the graph above).

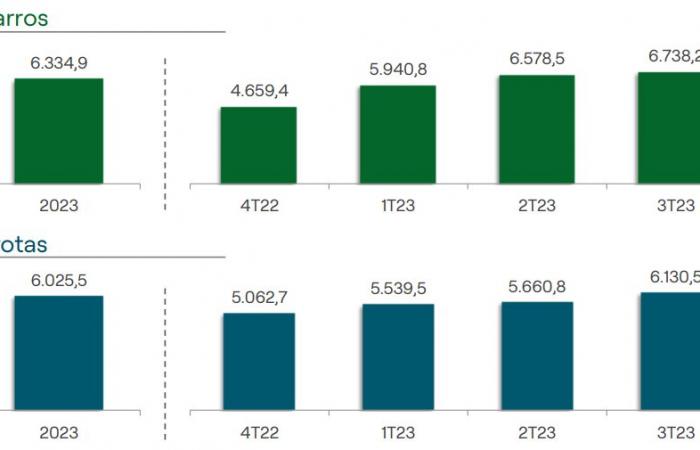

Evolution in the average annualized depreciation per Localiza car

It is important to highlight that the depreciation figures for the 4th quarter include the effect of excluding the cost of preparing the vehicle for sale in the depreciation assumption (we talk about this in the comments on the result). The “normalized” numbers would be around R$7,300 in Car Rental and R$7,600 in Fleet Management.

The current question is whether this scenario is structural or cyclical, and what the company can do to overcome it and regain an ROIC Spread of 5-8 percentage points.

- [Carteira de dividendos gratuita] Look 5 actions What analysts recommend for those looking for ‘fat’ dividend profits; access for free here

Structural or Situational?

The term perfect storm fits well with Localiza’s recent moment. The company is experiencing a combination of circumstances not experienced in its decades of history:

i) Credit for individuals extremely expensive and restrictedreducing demand for used cars;

ii) Zero car MPwhich boosted demand for new cars through subsidies for automakers, further drove down the price of used cars.

iii) Worst mix in historywith the average age of the fleet reaching 30 months, while the average was around 15;

iv) New car price remained high due to inflation and more “premium” launches and less market entry.

v) Cost of debt is currently very high, depending on the current Selic level.

Furthermore, all of this occurs while the company is consolidating the biggest merger in the history of the sector, with its biggest competitor, United.

Valid for other analyses, we believe that the best or worst moment rarely becomes the base scenario, it is usually something in between. Not quite to heaven, not quite to hell. And, looking at what brought the company here, We believe that these circumstances are cyclical and profitability should reach its historical levels.

Only the downward movement in basic interest rate should already contribute some basic points to this story. In addition to reducing the cost of debt, it should also improve the conditions for granting credit for the purchase of used cars, gradually recovering demand and, consequently, prices.

In the last chart, we have already seen a better bid-ask spread, indicating signs of improvement in the market. Both Localiza and Movida executives (its main competitor) signaled that the used car scenario is better in the first two months of 2024, mainly due to more favorable credit conditions.

Furthermore, market data indicates much more stable prices for used cars.

Finally, the fleet demobilization process should bring depreciation to more balanced levels when these older cars leave the fleet, although there are doubts about the speed and price at which this will occur. The signs are positive too; the average age of the fleet, which was 30 months at its worst, has now reached 26.

What is Localiza doing at home?

In addition to the macro playing an important role, Localiza has been doing a relevant sales effort to accelerate the fleet renewal processthrough the opening of new used stores and seeking to increase sales for PF (which has better margins than wholesale).

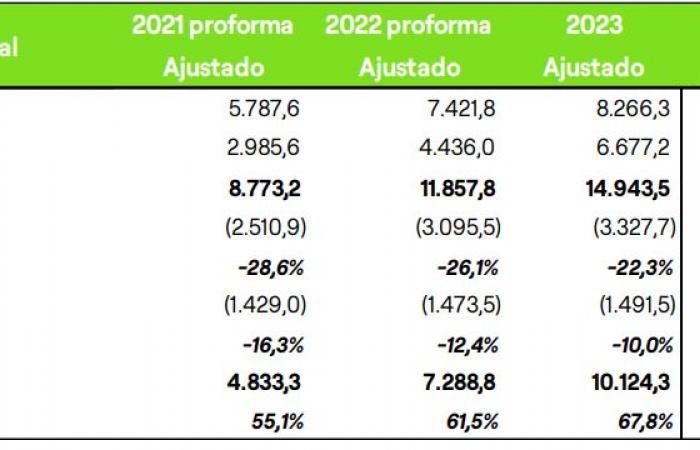

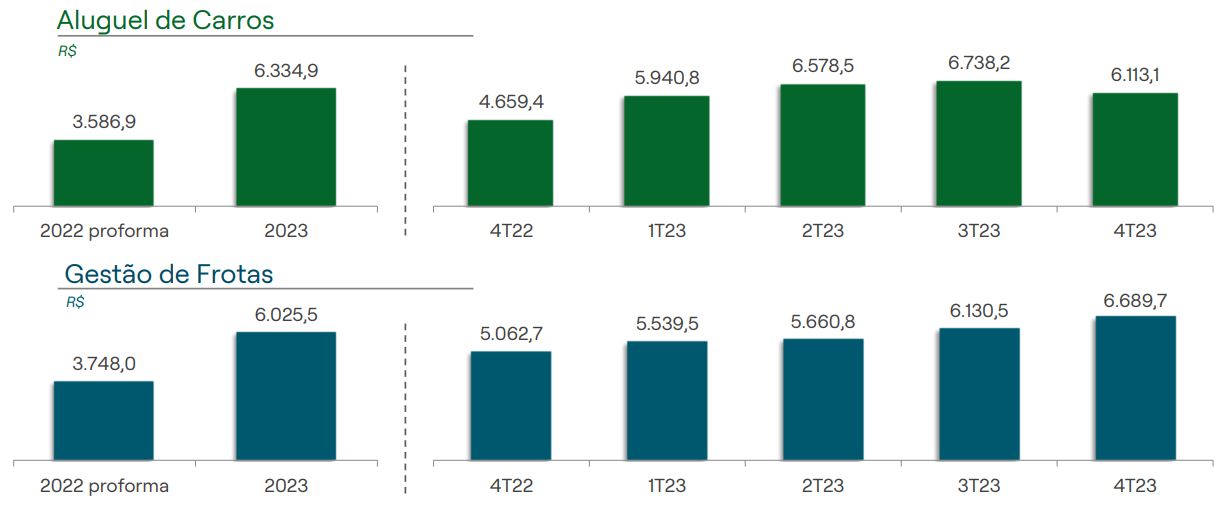

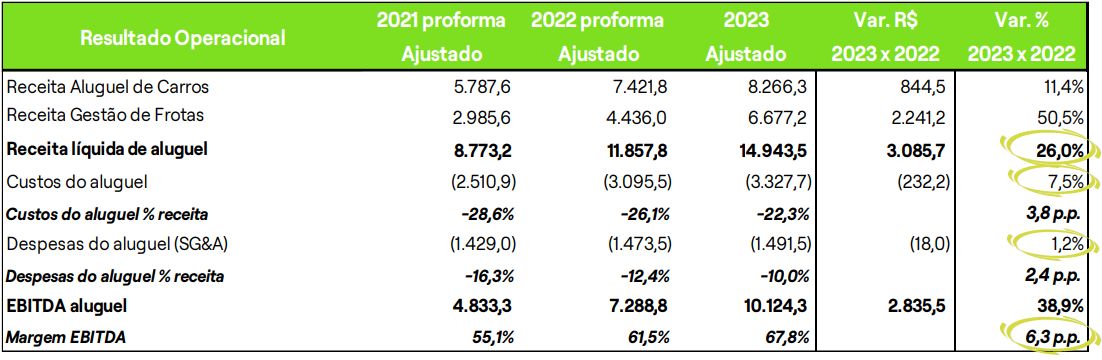

In relation to rental contracts, the company has been able to increase prices above 2 digits without compromising volumes, which, on the contrary, are also growing vigorously, both in Car rent and in Fleet management.

The contract pricing has the calculation premise that this new price will reach the desired ROIC Spread of 5-8 percentage points.

Therefore, even if the challenging moment in the used car market and high depreciation continues, the company should gradually return to business profitability through the implementation of these new contracts.

It is also notable the efficiency gain in the last yearwith costs growing much less than revenues and strong dilution of operating expenses.

Furthermore, the evolution of the fleet rejuvenation process should reduce maintenance costs with more used cars.

These adjustments to the operation are structural and we believe that they should generate important gains in profitability for the company under normalized circumstances.

Furthermore, it is important to highlight that the entire sector is being affected by the current situation.

We see Localiza with very large comparative advantages over competitorswith currently unmatched scale and efficiency.

Thus, within a market still extremely underpenetratedwe are confident that the company will emerge with even more relevant market share and advantages.

Trading at 16 times earnings for 2024, with conservative assumptions, the Locate (RENT3) follows as recommended by the Book of Actions.